Want more housing market stories from Lance Lambert’s? ResiClub in your inbox? Subscribe ResiClub newsletter.

While home buyers and home sellers are still seeing headlines about the housing market being a seller’s market and national home prices hitting all-time highs, a closer look shows that several regional housing markets are changing and giving home buyers some leverage.

During the pandemic housing boom, from the summer of 2020 to the spring of 2022, the number of active homes for sale in most housing markets plummeted as homebuyer demand quickly absorbed nearly everything that came up for sale. Fast forward to the current housing market, and the places where active inventory has risen to 2019 levels (due to cheap prices dampening buyer demand) are now where homebuyers have the most leverage.

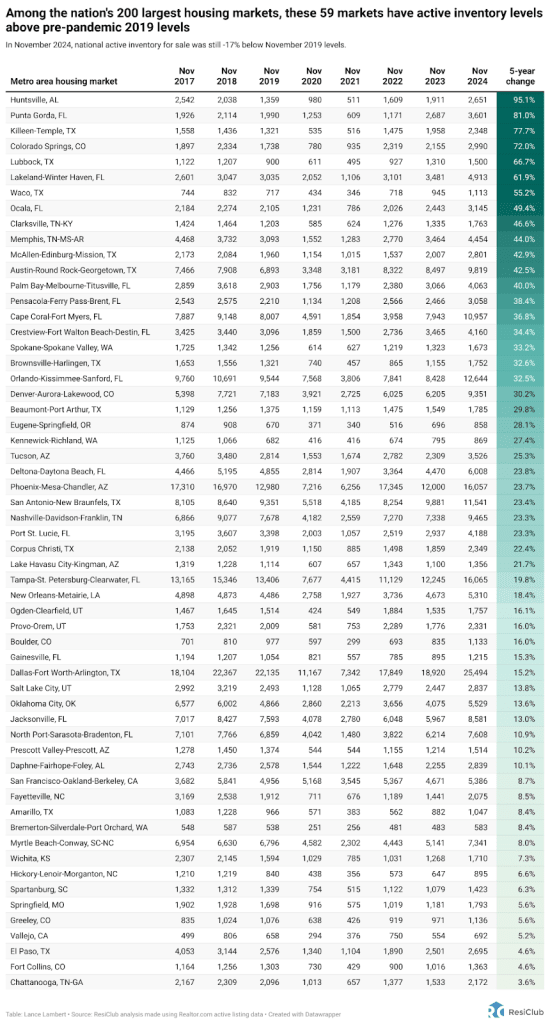

National active inventory for sale in November 2024 was still 17% below November 2019 levels. However, more and more regional markets are exceeding this limit.

Among the nation’s 400 largest metro area housing markets, 59 markets ended November 2024 with more active homes for sale than in November before the pandemic. These are the places where homebuyers will find the most leverage or market heading into 2025. balance.

Many of the softest housing markets where homebuyers have leverage are located in the Gulf Coast and Mountain West regions. These areas were home to many of the nation’s top pandemic boom towns, which experienced significant home price increases during the pandemic housing boom, driving housing fundamentals far below local income levels.

As pandemic-induced migration slows and mortgage rates rise, markets like Punta Gorda, Florida, and Austin, Texas, face challenges as they must rely on local incomes to maintain buoyant home prices. The housing market softening in these areas has been accelerated by an abundance of new home supply in the pipeline along the Sun Belt. Builders in these regions are often willing to cut prices or adjust affordability to maintain sales. These corrections in the new construction market also have a chilling effect on the resale market, as some buyers who have opted for an existing home are turning their attention to new homes where deals are still available.

In contrast, many Northeast and Midwest markets were less dependent on pandemic migration and less new home construction is underway. With less exposure to this demand shock, active inventory in these Midwest and Northeast regions remained relatively tight, keeping the advantage in the hands of home sellers.

!function(){“use strict”;window.addEventListener(“message”,(function(a){if(null 0!==a.data)[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r=0;r[r].contentWindow===a.source){var i=a.data["datawrapper-height"][t]+"px"e[r].style.height=i}}})}();

In general, housing markets where inventory (ie, active listings) have returned to pre-pandemic levels have experienced weaker growth (or outright declines) in home prices over the past 24 months. Conversely, housing markets where inventory remains well below pre-pandemic levels have generally experienced stronger home price growth over the past 24 months.