Today, NVIDIA Corporation (NASDAQ: NVDA ) became the first company to pass a premarket valuation of at least $5 trillion.

It marks a major milestone in the history of the stock market and shows that other unimaginable valuations were not reached once.

But NVIDIA is not the only company to break the trillion dollar mark. Fellow tech giants like Apple, Meta, and Broadcom are also close to breaking their own thirteen-figure barriers.

Here’s what you need to know about NVIDIA approaching $5 trillion as they climb into the most exclusive club on the planet.

NVIDIA Hits $5 Trillion Market Cap in Premarket Trading

As of this writing, NVIDIA has become the first company to cross the $5 trillion valuation mark. In premarket trading, NVDA shares are currently up 3.65% to $208.37 per share.

With approximately 24.3 billion shares outstanding, this puts NVIDIA’s current premarket valuation at just over $5 trillion. After the opening bell, NVIDIA’s stock price level is fattening its place in the record books.

The company’s current pressucet jump follows the stock’s nearly 5% gain yesterday. These gains were primarily driven by recent announcements from the company that raised investor expectations.

As CNBC notes, NVIDIA announced plans yesterday to build seven new supercomputers for the US government, including at Los Alamos National Laboratories.

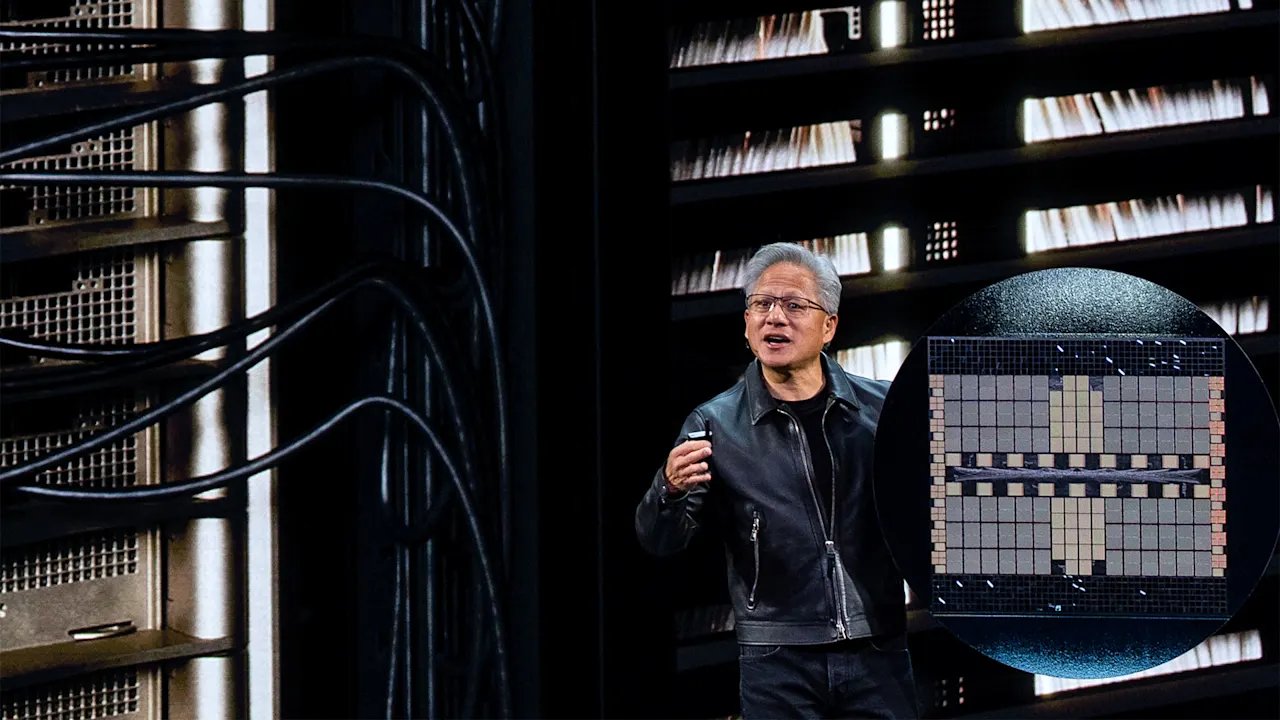

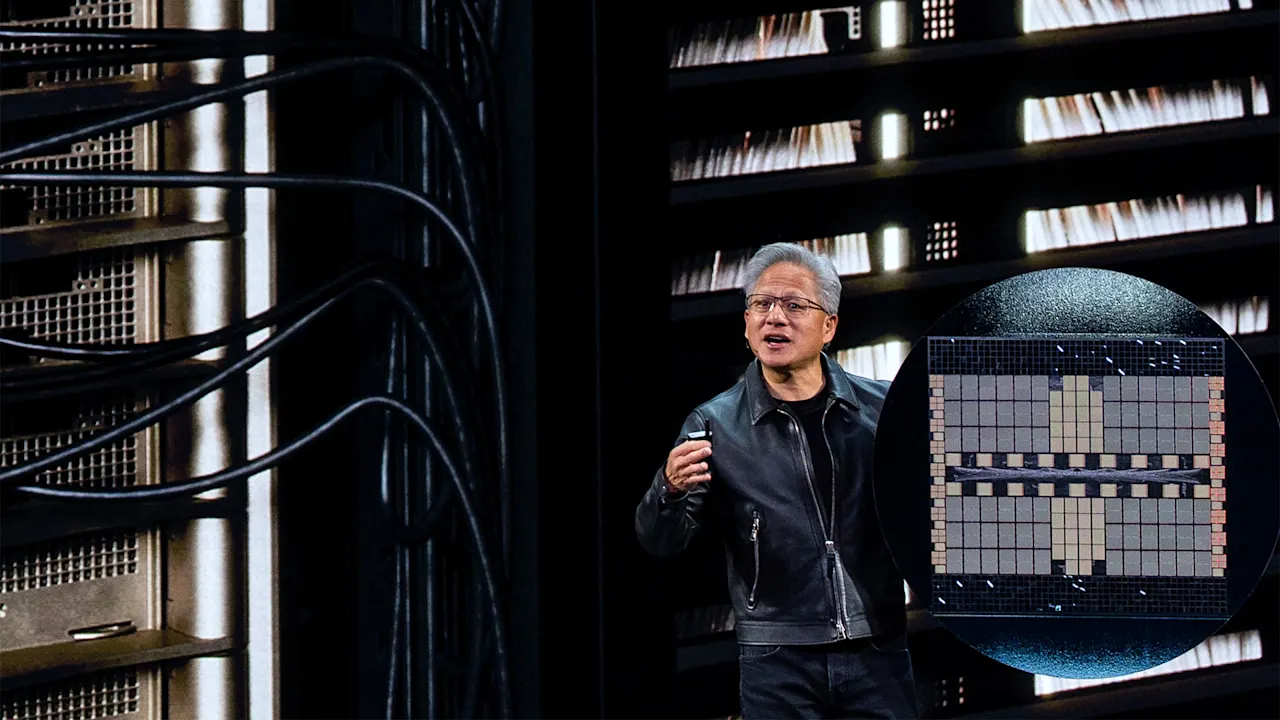

Separately, NVIDIA CEO Jensen Huang revealed that the company’s all-in-one Blackwell GPU is fully manufactured in Arizona, USA. This allows NVIDIA to produce more of its AI chips, which can help meet the demanding demand for its processors.

But there’s another factor that could be encouraging to NVIDIA investors. Reuters reports that President Trump is meeting with regional leaders in Asia this week. The Chinese President will meet with Xi Jinping tomorrow.

Today, Trump announced that he will speak with the Chinese president about NVIDIA’s Blackwell chips, which are currently banned in the country. The lifting of this ban could greatly increase Nvidia’s bottom line if the company can once again sell its chips.

Investors feel that this trio of positive news means the company has a chance of profitability, so the $5 trillion barrier falls.

Other companies are close to breaking trillion dollar milestones

Nvidia’s $5 trillion milestone isn’t the only palm barrier broken this week.

Yesterday, Apple Inc. (Nasdaq: AAPL ) crossed the $4 trillion barrier for the first time before a market valuation of $3.99 trillion on the day.

Apple’s $4 trillion entry made it the third company to break the barrier, after NVIDIA and Microsoft Corporation (Nasdaq: MSFT ).

If nothing happens, it’s possible that it could cross the $4 trillion mark again today.

And Apple and Nvidia aren’t the only companies below the trillion-dollar threshold. Two other companies are also in the range.

Facebook-owned Meta Platforms (NASDAQ: Meta ) had a market cap of $1.88 trillion at yesterday’s close. That’s less than $120 billion short of breaking the $2 trillion barrier, a first for the company.

Semiconductor and Internet infrastructure company Broadcom Inc (Nasdaq: avgo ) is relatively close to breaking the trillion-dollar barrier.

Closer to yesterday’s market, Broadcom had a market cap of $1.76 trillion. That leaves less than $250 billion out of the $2 trillion club.

Of course, while these companies are the closest to their next trillion-dollar hurdle, there’s no guarantee that their stocks will continue to climb higher, or how much they’ll take.

But topping their ranks is yet another example of unimaginable trillion-dollar market caps becoming more commonplace.

Complete list of the world’s trillion dollar state-owned companies

For those keeping track, according to data compiled by CorporationetCap.com, the market is worth $11 trillion based on yesterday’s stock prices. Those companies:

- Nvidia ($4.89t)

- Microsoft ($4.02t)

- Apple ($3.99t)

- Alphabet ($3.23t)

- Amazon ($ 2.44t)

- Meta ($1.88T)

- Broadcom ($1.76t)

- Saudi Aramco ($1.66t)

- Tsmc ($1.56t)

- Tesla ($1.53t)

- Berkshire Htaway ($1.03t)

A big technological gain could influence the trajectory

It will be interesting to see how the current tech earnings season affects the market cap of many of these companies.

Investors will be wondering how the AI boom is affecting the bottom lines of companies such as Microsoft, Alphabet and Meta, all three of which are expected to report financial results after the closing bell today (Wednesday, October 29).

Wall Street will also be watching for any updates from these companies on their capital spending plans as the AI Boom demands huge investments from the world’s biggest tech giants.

If investors don’t see signs of Ai investments being worth the cost and slowly sharing prices, they could push them further into the trillion-dollar club.

But investors, many, many, many in an Ai-fueled bubble may see their ratings of companies in the trillion-dollar club slide as their stock prices fall.