Asking Lance Lambert more apartment market stories ResistubIn the Inbox? SubscribeResistubBulletin.

Speaking before the US Senate this month, the federal prescription Jerome Powell will not be able to find home insurance in some parts of the country, a decade or more.

“Both banks and insurance companies are leaving the coastal areas where there are a large number of fires. Thus, if you are progressing at a speed of 10 or 15 years, there will be areas of the country where you cannot mortgage,” said Powel Congress. “It will not be [mortgage] ATMs will not be banks [lending mortgages]Therefore, home owners and residents will fall. However, this will fall to state and local governments. In situations where the insurance goes, where you step in steps are what you see happening now. You see states step by step because they want these areas to bloom. “

To hear that a comment is made by a professor or analyst. However, it is a little incredible to the apartment sector from the seat that is fed. This question raises: Does any of which housing markets have a data there to suggest how the bank and home insurer can be with the risk of retreating retreat?

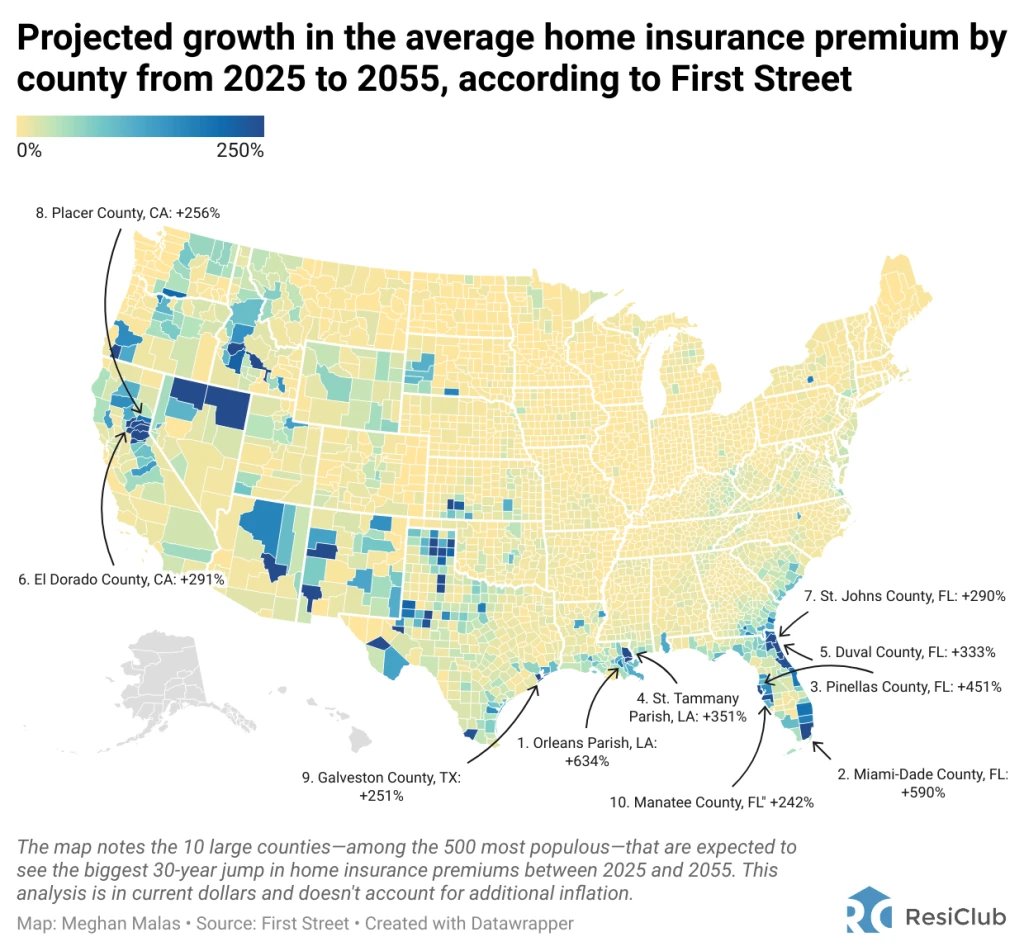

Resistub Some drilling and first street found a new proprietary analysis developed by the first street based on the risks assessing the risk of proprietary and assessing the expected climate risk – between 2025 and 2055

In order to see homeowners and investors can most affect Resistub Visual first street-Linking level home insurance forecasts. (Pay attention to the guide, if you find a 30-year forecast for a 30-decade project for the future for three decades of work for the future, it is likely to find a 30-year forecast of those with 2025.

We asked the first street if the future inflation considers analysis. “These are [insurance] Values are not for today’s dollar, with the only regulation associated with the increase in climate exposure, but for no expectations around inflation or market adjustments. . . . These values are not adjusted in inflation in any way, “says the first street Resistub.

Among the most populous countries, this is the 20th largest increase in the home insurance rights of the first street.

- Orleans Parish, Louisiana: + 634%

- Miami-Dade County, Florida: + 590%

- Pinellas County, Florida: + 451%

- St. Tammyany Parish, Louisiana: + 351%

- Duval County, Florida: + 333%

- El Dorado County, California: + 291%

- St. Johns County, Florida: + 290%

- Placer County, California: + 256%

- Galveston County, Texas: + 251%

- Manatee County, Florida: + 242%

- Volusia County, Florida: + 242%

- Clay County, Florida: + 240%

- Palm Beach County, Florida: + 195%

- Brevard County, Florida: + 189%

- Broward County, Florida: + 182%

- Coconino County, Arizona: + 173%

- Hillsborough County, Florida: + 162%

- Nueces County, Texas: + 158%

- Hernando County, Florida: + 152%

- Lafayette Parish, Louisiana: + 149%

The risk of floods, hurricanes and tropical storms indicates the largest insurance growth around the Gulf of the first street model. In fact, the largest increase in Florida is 12 of the 12th district of the 20th district expected to see the largest increase.

Like Resistub Earlier, the hosts in these areas are already living in insurance trips. The media’s annual home insurance award has increased by 33% in the late 2020 and the end of 2023, and in many Florida countries increased by more than 80%.