Asking Lance Lambert more apartment market storiesResistubIn the Inbox? SubscribeResistubBulletin.

During the pandemic housing boom, the apartment demand increases the demand of rapidly increasing the requirement of increments or unlocked “WFH Arbitration” or an unlocked “WFH Arbitration” requirement and the remote business boom has increased rapidly. Federal Reserve Researchers Evaluation “The new building will increase by about 300% to increase the required pandemic period.” Unlike apartment requirement, the housing supply is not elastic and cannot quickly ramps. As a result, the pandemic cycle, active inventory and extremely high-led duty-free home prices, home prices, 202020 and an amazing 43.2% amateur house prices with increased home prices.

Many commentators see the number of active inventory and supply, as “supply” measures, Resistub sees the demand for supply as a proxation. Because the apartment requirement is more elastic than housing resources, active inventory or large swings in the deliveries are usually controlled by the required queues. For example, during the pandemic landscape boom, the demand for growth caused even new lists to sell down a stable inventory of houses. On the contrary, in recent years, the requirement of weakening caused more growing sales, caused an increase in active inventory – as soon as the new lists fall.

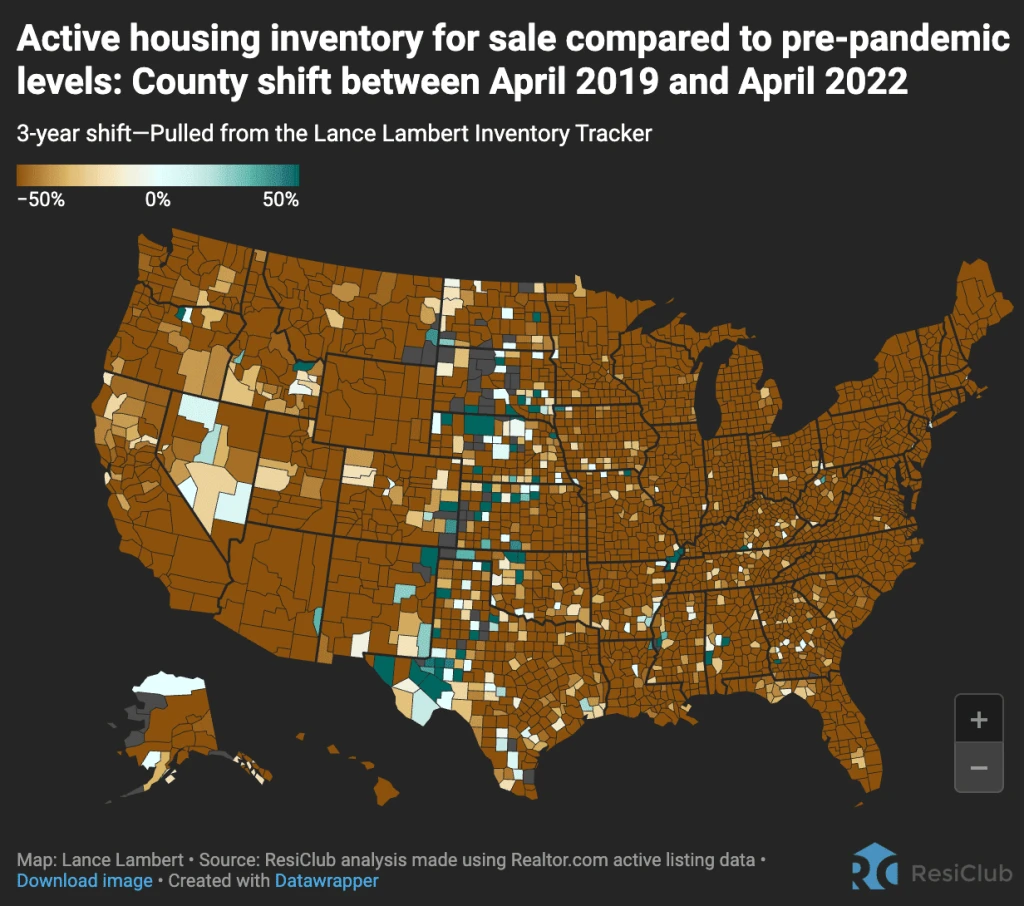

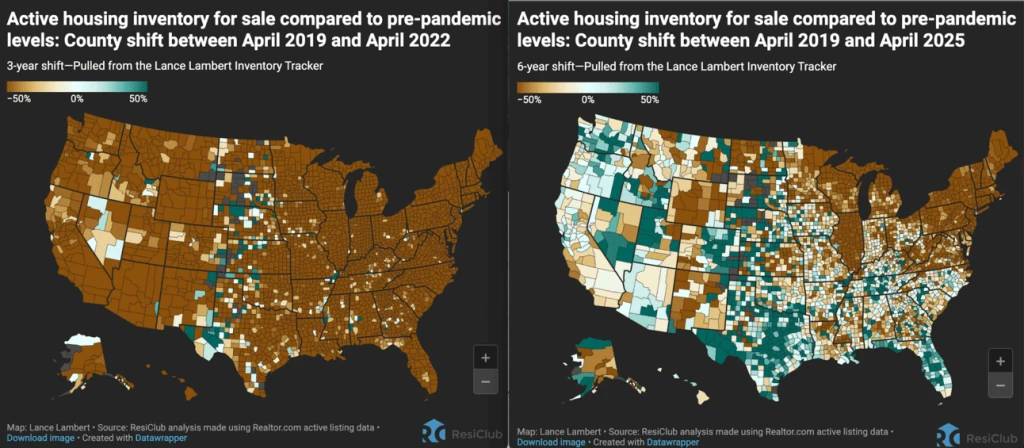

Indeed, in April 2022, the pandemic housing boom was at least 50% lower than in 2019 active inventory levels before 2019.

Brown = Active Housing Inventory for Sale in April 2022 is PANDEMIC to PANDEMS of 2019

Green = Active Housing Inventory for Sale in April 2022 is PANDEMIC to PANDEMS of 2019

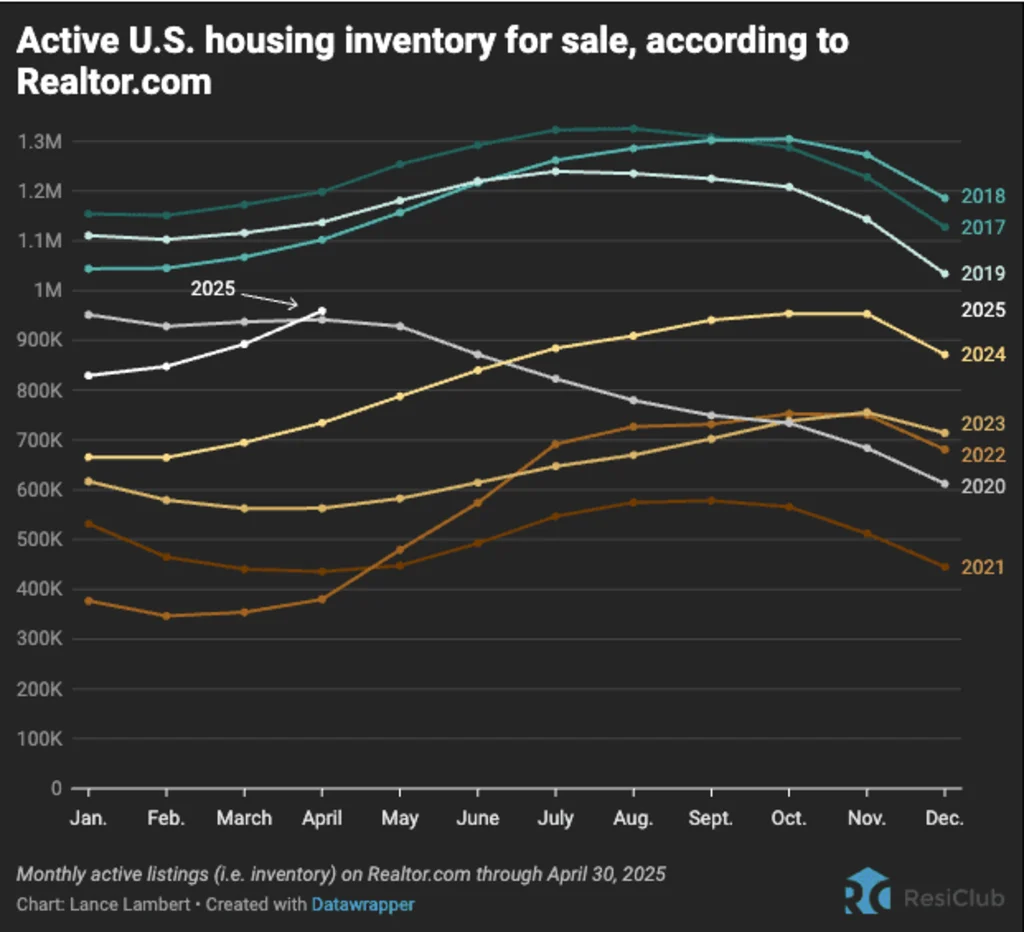

Of course, now there is a different picture: a million active inventory is a perennial rise.

After the mortgage pace was worn in 2022, in 2022, the Pandemic housing boom reflects the reality of a sharp home price and increased the balance of the office for sale and the pandemic apartment boom flashed. Initially, in the second half of 2022, the retreat of housing requirements, especially in a number of markets in a number of markets, especially in Pandemic Boomtowns, in Pandemic Boomtowns, which are in the Pandemic Boomtowns, pushes these markets in the second half of 2022.

Started in 2023, the same Western and Pandemic Boomtown Markets (Austin) stabilized, because the Spring seasonal requirement was still closed with the level of active inventory – it was enough to temporarily strengthen the market. A little, nationally stopped an increasing inventory since the active inventory.

However, this period of national inventory stabilization did not continue. As a result of the housing requirement, the national active inventory began to rise again, and now we are among the 18-month-old strip of growth in the national active lists.

The most rose to the most rising in the most active inventory / monthly supply, homebuyers won the most goals. In general, the inventory (ie active lists), where the pre-pandemic 2019 levels, housing markets have experienced a weak home price increase (or open landing) for the last 34 months. On the contrary, where the inventory stays before the Pandemic 2019 level, it is usually located in places where the stronger home price increases in the last 34 months.

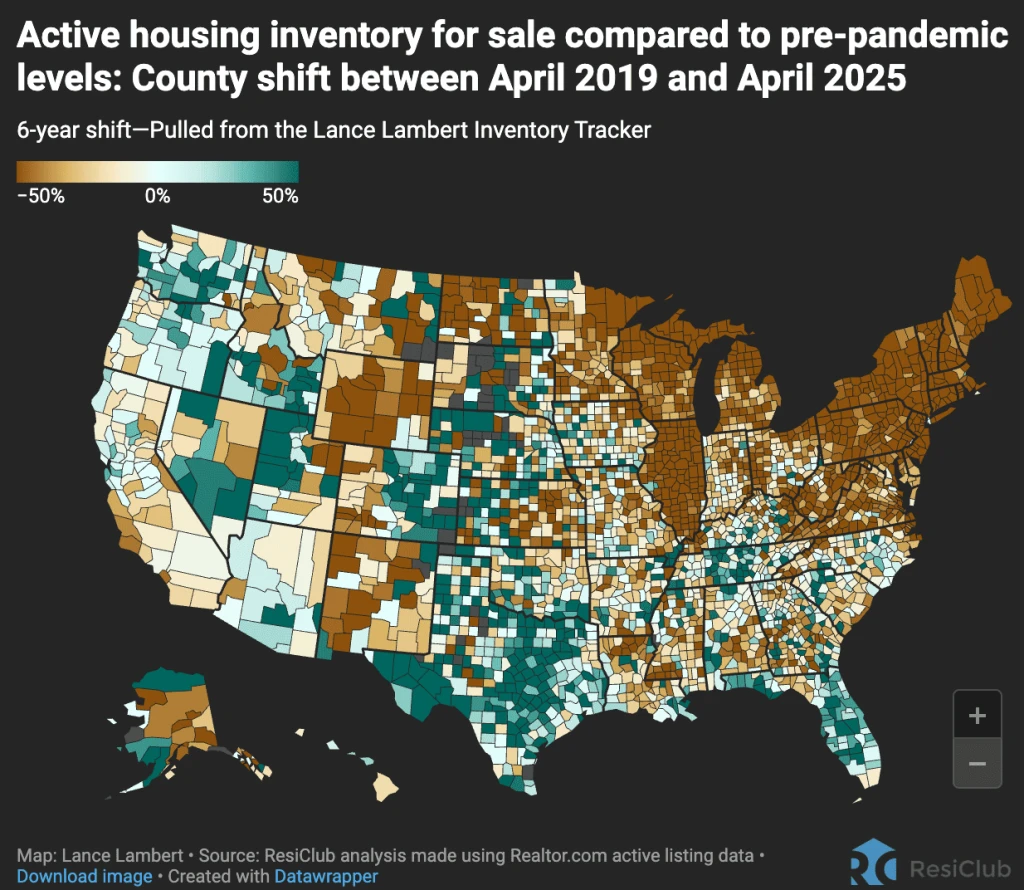

Brown = active housing inventory for sale in April 2025 was the previous level of 2019 pandemic

Green = Active Housing Inventory for Sale in April 2025 was above the PANDEMIC level from the level of 2019

This picture changes significantly within the country because the resistub is closely documented: Most of the Northeast and Midwest remain before the Pandemic 2019 inventory level, many parts of the mountain west and the Gulf regions are retracted.

Most softest housing markets earned by homebuyers are located in the Gulf Coast and mountain western regions. These areas were among the best Pandemic Boomtowns of the people living an important home price increase in the basu of the pandemic landscape, which extended the basement of housing outside the local income. When the pandemic fueled domestic migration is slowed down and mortgaged rates, Texas Kap Coral, Florida and San Antonio, the company faced problems for the company to protect their dog house prices. In these areas, the softening housing market has accelerated with a new home supply along the Sunscreen with a higher new home supply. In these areas, builders often want to reduce prices or make other inventory adjustments to protect sales in a shift environment. These amendments in the new construction market also create a cooling effect in the sale market, because some buyers who can prefer a house have turned their attention to new houses where transactions are still available.

On the contrary, many northeastern and Midwest markets have been relied less for pandemic migration and the less new home construction continues. This internal migration requirement demand the demand of the demand, and fewer builders in this Midwest and more convenient adjustments to move productive inventory in the north-eastern regions, the Gulf and mountain western regions are relatively close to home vendors than their peers.

At the end of April 2025, the national active inventory still expects to overcome 2019 before the Pandemic before the pandemic.

Great picture: The housing market is still very fast, when the house is very fast, the normalization process is carried out in a growing process during the apartment requirement during the apartment boom. To date, the process of normalization, Austin (secondary 2022), Las Vegas, Phoenix (2022), San Francisco (second half of the 2022), Punta Gorda (2022), Cape Coral (2022), (2022-Current) -ito adjustment mode. In some other areas, so far caused a home price increase. Meanwhile, some markets still remain firm and saw a slowdown in home price growth, which only pandemic housing boom is high.

Resistub Pro members can include the latest monthly inventory analysis (+800 Metros and +3,000 countries) and here are the latest monthly home prices (+800 meters and +3,000 countries).