Are we at the peak of alternative investments?

Earlier this year, a fossilized stegosaurus skeleton (nicknamed “Apex” for its rarity and unusually high quality) was sold to hedge fund billionaire Ken Griffin for $44.6 million. It was the highest amount ever paid for a dinosaur fossil — easily beating the nearly $32 million paid for a Tyrannosaurus Rex in 2020.

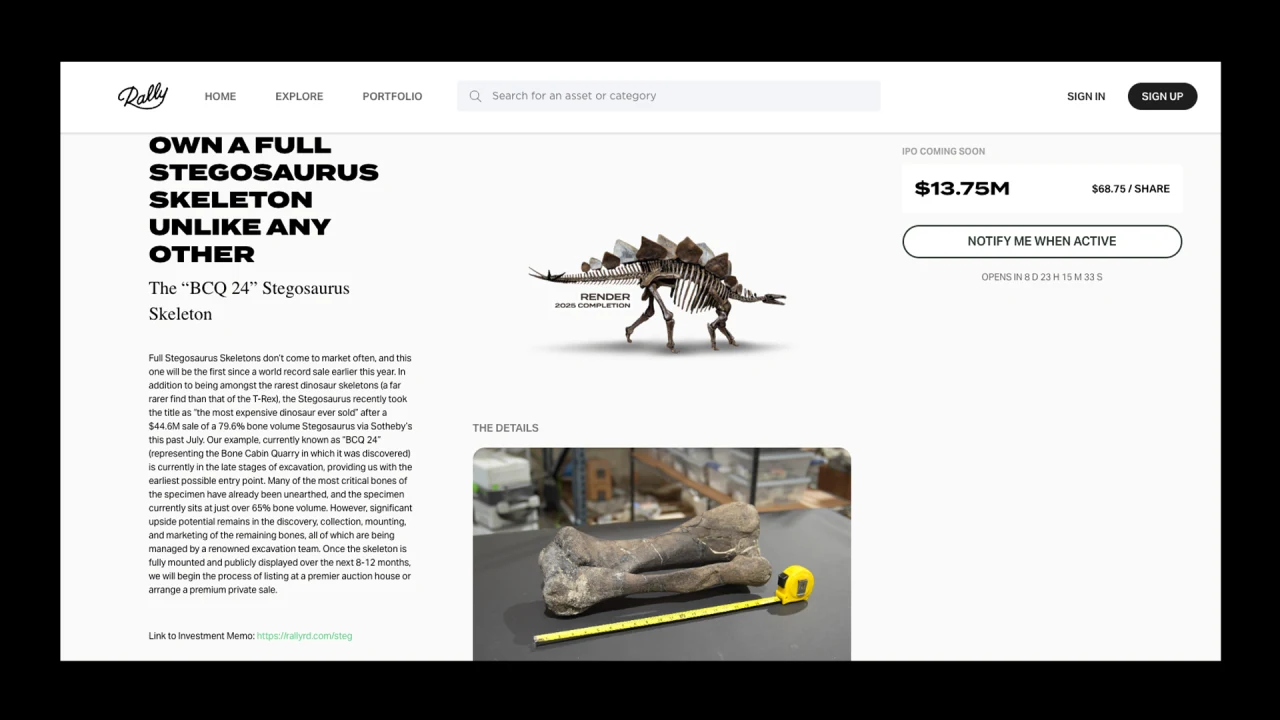

With astronomical price tags, anyone hoping to one day own a dinosaur skeleton is probably feeling out of luck. But not so fast: Rally, an alternative asset investment platform, is gearing up for an IPO for another stegosaurus skeleton that lets investors buy shares and effectively own a piece of the past.

The IPO, which goes live later this month, will allow investors to buy one of 200,000 shares of the $13.75 million, 160-year-old stegosaurus for $68.75 each, said Rob Petrozzo, Rally’s co-founder and chief product officer.

And Petrozzo says that the stegosaurus IPO is the result of a lifelong dream for him and a long-term goal for Rally as well.

“This is the most important offering we’ve ever made as a business,” he says, adding that opening up the opportunity to invest in dinosaurs and fossils has always been one of his goals.

“In the past, we’d IPO an asset and then go public – it’s a little bit different in that the asset is worth a lot more than any asset we’ve ever owned,” he said. “It’s not the same as finding a rare watch.”

Not everyone likes the idea

The stegosaurus skeleton, still excavated at the Bone Cabin Quarry in Wyoming, will eventually make its way to New York, where it will be on display for stockists and the public.

The sale of dinosaur fossils has been controversial in the past.

“Continuing debates about the existential nature of ownership concern those who believe that artifacts of this type should be housed in museums open to the public (and in the legitimate museum-country of the artifact’s origin). Against others who advocate for the free market to have its way,” wrote Frederick Bertley, president and CEO of the Center for Science and Industry. Fast Company in July.

Indeed, most countries prohibit the mining, sale and export of fossils. But Petrozzo says the relatively lax regulations in the U.S. that allow stegosaurus to be sold to investors make it even more special.

“The US is one of the only places on earth where it’s legal to find and sell fossils, which adds to the scarcity,” he says.

All in all, this presents a very rare opportunity for investors to own something that is the ultimate portfolio diversifier, unlike shares of QQQ or Coca-Cola stock. “It’s more interesting than sign symbols,” says Petrozzo.