They are widely used in the periphery inserted central catheters (PICCK) and is usually used to produce chemotherapy, antibiotics and blood gain. The PICCK is introduced through the main basilic, Cephalic or median cubital veins and then the tip of the catheter is then directed to the Superior Vena Cava (SVC). Usually the devices are used from one week to three months, but can be used from a few days for more than a year. This flexibility distinguishes PICCs from other vascular access catheter and generally contributes to the increased use of PICCK.

Although the number of picc procedures is relatively small as the involvement of central venous catheters (CVC), PICC -ka market share is removed from other types of catheter. This is due to the fact that PICCCs are associated with a lower infection rate than CVCs and are generally more convenient for patients because they are placed in the arm, not the neck or chest, where CVC is usually inserted. This increased comfort can contribute to better satisfaction of patients and to follow treatment.

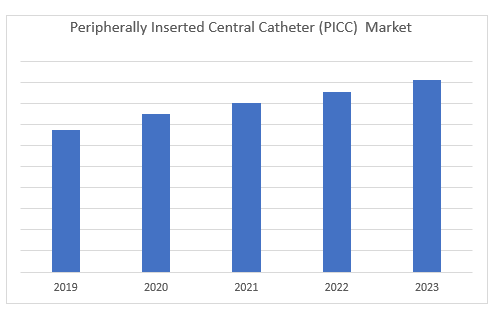

The central catheter (PICC) market is around Europe around the periphery $ 40 million in 2022 and forecasts are close to $ 65 million in 2029indicates a Its impressive growth rate of about 60%– In the category of intravenous catheters, PICCC -K is a separate option. This article explores their unique qualities, benefits and market expansion factors. Discover why PICCs have become a valuable choice for long-term intravenous therapy.

To explore the growing popularity of PICCCKs

Although PICCC -K replacement products such as midline catheters, PIVC (peripheral intravenous catheters) and EDC (extended residential catheters), they have separate properties and separate themselves in many key points of view. PICCCs offer many benefits like EDCs. This includes the lack of extended stays and the lack of cutting requirements before insertion. While EDCs are relatively shorter, typically 6 cm or less approx. PICCC provides many benefits over PIVCs, such as longer time and access to larger veins. PICCCs are inserted on a periphery, but they can get into the central circulation deeper, making them suitable for patients who require longer-term intravenous therapy but do not need the invasivity of the middle catheter.

Many factors contribute to the expansion of the PICC market in Europe. First of all, the prevalence of chronic diseases increases and requires persistent intravenous treatments. Secondly, increasing demand for home health services further enhances the adoption of PICCKs by allowing patients to treat treatment in their own home. Third, the technological development has led to the development of advanced and safer catheter materials and patterns, improving the overall efficiency and safety of PICCCK.

Overall, PICCs have appeared as a valuable opportunity for patients requiring long-term intravenous therapy. Contrary to traditional methods, their benefits to PIVC make them an attractive choice for healthcare providers, which results in a steady increase in the PICC market.

Driving factors on the PICC market

Four main factors dictate the growth of the European PICC market: refund, practitioners, infection rates and technological improvements.

First of all, the refund is a significant leadership factor in most countries of the European Union (EU) due to the refund of higher and more profitable ports. However, the high value of PICCC’s refund market has led to the underdeveloped market of PICCCK in Germany.

Second, the placement of professionals plays a huge role in how the PICC market works in a particular country. For example, in countries where nurses cannot allow picc, the use is lower; This includes countries like Portugal, Belgium and others. In contrast, countries such as Italy, whose strong nurses are trained to insert PICCKK, experience significant PICC sales. There are also countries that are growing in the PICC market due to political changes. Namely, in France, in a country where nurses have traditionally been limited to the placement of PICC, there has been a significant change in recent years. This change of trend resulted in a remarkable boom in the French PICC market.

Third, the infection rate is lower when using PICCs compared to other options, such as non -coated CVCs. While this is the leading factor in the market, it should be noted that the efficiency and cost -effectiveness of these devices have not been fully investigated and experiments such as cancer and venous access (CAVA) provide a comparative analysis to the main vascular access tools.

The fourth, new and improved technologies, such as ultrasound instructions and the most important confirmations of ECGs, have allowed companies to acquire higher ASPs for their products.

Covid-19 effect on the picc landscape

Ensure effective and safe vascular access to critically ill Covid-19 patients is unique challenges for minimizing viral transition to health workers and the surrounding environment. Ensuring fast, safe and lasting access becomes of paramount importance in these circumstances.

Emerging research has revealed remarkable differences in procedures for access to central veins between Covid-19 and non-Covid-19 patients1– In addition, Covid-19 patients often require alternative methods for vascular access2Or

One of the most important benefits of PICCC is that the frequency of Needlestick injuries is due to the higher success of the first scandal. In addition, the extended residence time provided by PICCKs reduces the need for subsequent inserts. Although PICCCs offer many benefits over mid lines, EDC and PIVC, it should be noted that they are more expensive. The markets in the midfields, the EDC -K and PIVCs in 2020 experienced a significant decline due to Covid, and the growth observed in 2021 is attributed to the recovery phase. In contrast, Covid had relatively less influenced the PICC market, which showed more flexible performance.

%20Market%20Size%202019-2023.png?width=497&height=312&name=Peripherally%20Inserted%20Central%20Catheter%20(PICC)%20Market%20Size%202019-2023.png)

Picc market growth and resistance in Europe

In 2022, the European PICC market increased at a moderate rate. The market value is mainly guided by the increase in unity sales and the low digits of ASP growth. ASP growth is due to the use of more expensive energy injection PICCs and the conversion to more expensive tip placement configurations.

The growth in the PICCC market is the result of some procedures from PICCC -ka ports, CVCs and PIVCs, as well as a new indication of PICCC. The unit of each segment is expected to remain reasonably permanent during the forecast period. One Lumen Picc is well supported on the market because the lower number of lumens in the past is lower than the rate of infection.

Despite the initial disorders caused by pandemia, the market bounced strongly and returned to pre-congress growth rates until 2022, such as increasing acceptance of PICCs in a critical nursing environment, increasing health spending and continuous technological development.

Closing thoughts

The European market for the periphery inserted on the periphery has experienced significant growth due to their benefits in intravenous therapy. With the duration of extended homes, the reduced complications and better safety, the PICCs have become popular. Factors such as the prevalence of chronic disease, demand for home health care and technological development contribute to market expansion. In addition, PICCKKs are making more and more procedures from another catheter, increasing growth with new signals. Despite the challenges, refund policies, practitioners’ placement requirements, infections and advances are shaping the market. Expected research improves efficiency, security and cost-effectiveness, ensuring the continuous growth of the European PICCC market.

For more information please read the report Market size of vascular access instruments, equity and trend analysis-European-2023-2029 Written by Idata Research.

About the authors

Salempoor Idata Research research analyst. He deals with research projects on medical devices, including the market for European vascular access tools and supplements.

Kamran Zamanian, Ph.D.CEO and founding partner of Idata Research. He spent more than 20 years in the market research sector, commitment to studying medical devices used by patients throughout the world.

About Idata’s research

For 19 years, Idata Research has strongly supported data -based decision -making on the global medical device, dental and pharmaceuticals. By providing individual research and counseling solutions, Idata authorizes its customers to trust the data source and make important strategic decisions.

References

1st Gidaro, A., Vailati, D., Gemma, M., Lugli, F., Casella, F., Coglii, C., … and Giustivi, D. (2022). Retrospective survey from the vascular access team from the Lombardy Net in the Covid-19 era. The Vascular Access magazineTo 23(4), 532-537.

2nd Chun, TT, Judelson, Dr., Rigberg, D., Lawrence, PF, Cuff, R., Shalhub, S., … and Woo, K. (2020). Treatment of central venous access during the health crisis. Journal of Vascular SurgeryTo 72(4), 1184-1195.