Want more housing market stories from Lance Lambert’s?ResiClubin your inbox? SubscribeResiClubnewsletter.

Starting with his first properties in 2001, Michael Zuber began building a portfolio of rental properties in Fresno. He sold much of his real estate portfolio just before the 2008 housing crisis and then re-entered the market after home prices fell.

By 2018, Zuber had grown his portfolio to over 170 rental properties and decided to leave his tech job in Silicon Valley to focus on his passion for helping others achieve similar success. Her YouTube channel, One Rent at a Time, has since amassed more than 60,000 subscribers, most of whom are single-family homeowners.

Zuber studies the financial and housing market every day and has become a leading voice in the mom-and-pop landlord space, representing the largest share of rental homeowners in the United States.

ResiClub‘s Meghan Malas recently interviewed Zuber about his thoughts and approach.

Interest rates have risen sharply since early 2021, so a lot of institutional capital going into the space has pulled back. However, on a percentage basis, we are still seeing a large number of single family home owner purchases from mom and pop single family home owners. How are single-family investors still finding deals in this type of market?

Mom and pop landlords have an advantage over Wall Street money because they are more flexible. There is only one property to be found compared to them, which makes it easy to find a needle in a haystack in today’s environment. Institutional investors these days tend to focus on newer, three- or four-bedroom homes less than a decade old.

Mom-and-pop landlords can target properties that don’t fit the institutional “buy” box by finding ugly ducklings or missed listings. While agencies rely on technology to scour the market for deals, mom-and-pop homeowners network and evaluate deals locally.

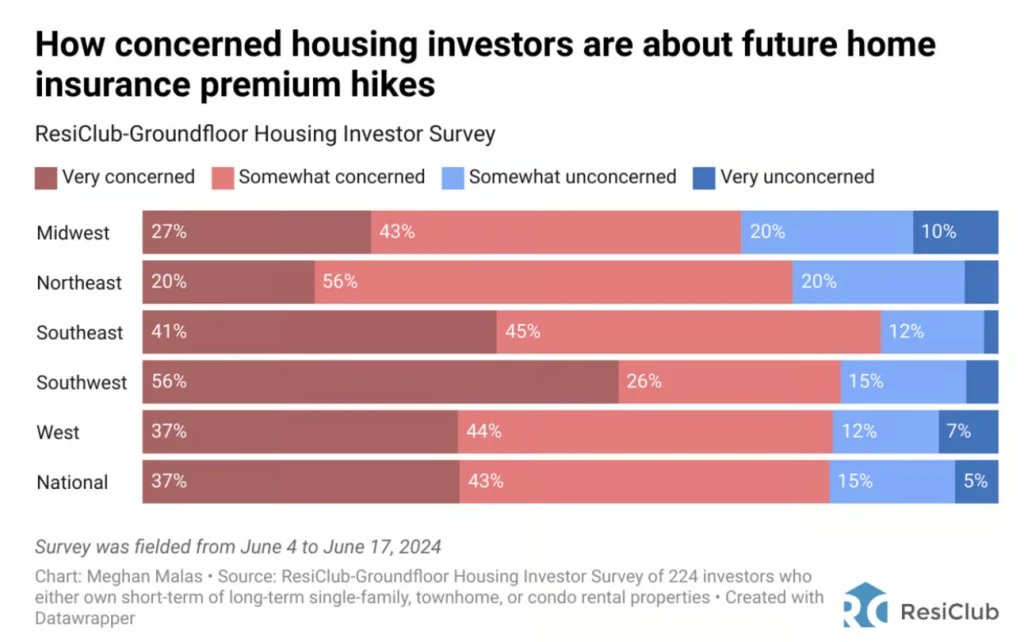

Again in June, a ResiClub-Ground Floor Apartment Investor Inquiry found that 80% of real estate investors are concerned about home insurance shocks. What should single-family investors look out for on the insurance front?

Insurance has become a front and center issue for homeowners. For over 25 years, I could estimate my insurance costs to within $20 or $30. But in the last two years, we started experiencing non-renewals and cancellations. There was a period in California when insurance companies completely left the market.

I had a quad for years where the insurance was consistently around $1900. When my provider refused to renew, the next carrier charged almost $3,200 for the same coverage.

Thankfully, exchange rate shocks, cancellations and renewals have eased in the last six months. If you’ve been in the game long enough, you’ve likely benefited from significant rent increases between 2020 and 2023. While insurance costs have increased by 50%, these rent increases often outweigh them.

As long as you manage your units effectively, higher insurance costs can be manageable, even if they hurt cash flow.

You’ve said before that today’s housing market is similar to the early 1980s—when housing affordability in the U.S. was very tight—can you explain why?

From 1978 to 1982, we saw a sharp increase in rates, which drastically reduced transactions. I made this call right after the 2022 Jackson Hole meeting, where Jerome Powell essentially said, “The pain is coming.”

You can see the pattern in my 54-year spreadsheet: From 1978 to 1981, existing home sales fell 50%, but the median home price rose.

In 2022, along with the rise, I predict a crash in housing transactions [national home] prices, many dismissed it as foolishness. Unfortunately, that’s exactly what happened.

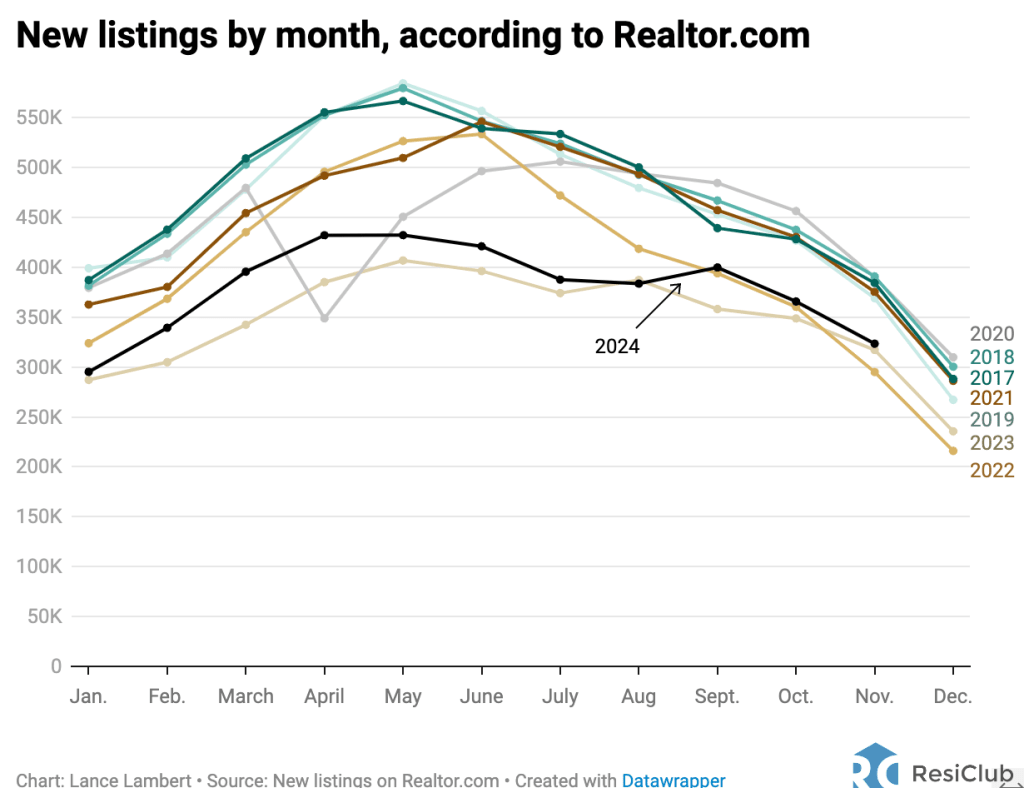

Before existing home sales and new listings fell sharply in 2022, you said the “Fed has cracked the housing market.” What did you mean by that and is it still going into 2025?

Traditionally, the housing market follows a normal cycle. First-time home buyers buy a home, stay for six to eight years, and then move up. This period was active for 40 consecutive years.

But consider someone who bought an entry-level home in 2020 or 2021. Today, they are more likely to not be able to afford their current home because the price has increased by 25% to 50%, rather than trade up for a better home. The math doesn’t work anymore. The house they want to buy is $100,000 more expensive, and mortgage rates have risen from 3% to 7%. As a result, the “moving buyer” has virtually disappeared from the market.

The lack of resettlement buyers disrupts the housing market, because their activity represents two transactions – sale and purchase. Without them, entry-level housing remains frozen. Homes for sale are higher end or luxury properties, which makes the market fun. Average home prices appear higher because low-priced homes do not [selling].

Comparing how many entry-level homes were sold in 2019 or 2020 to sales in 2024 or 2025 shows a significant drop — about 30% fewer. This is what defines a broken housing market.

What is your prediction for the housing market in 2025?

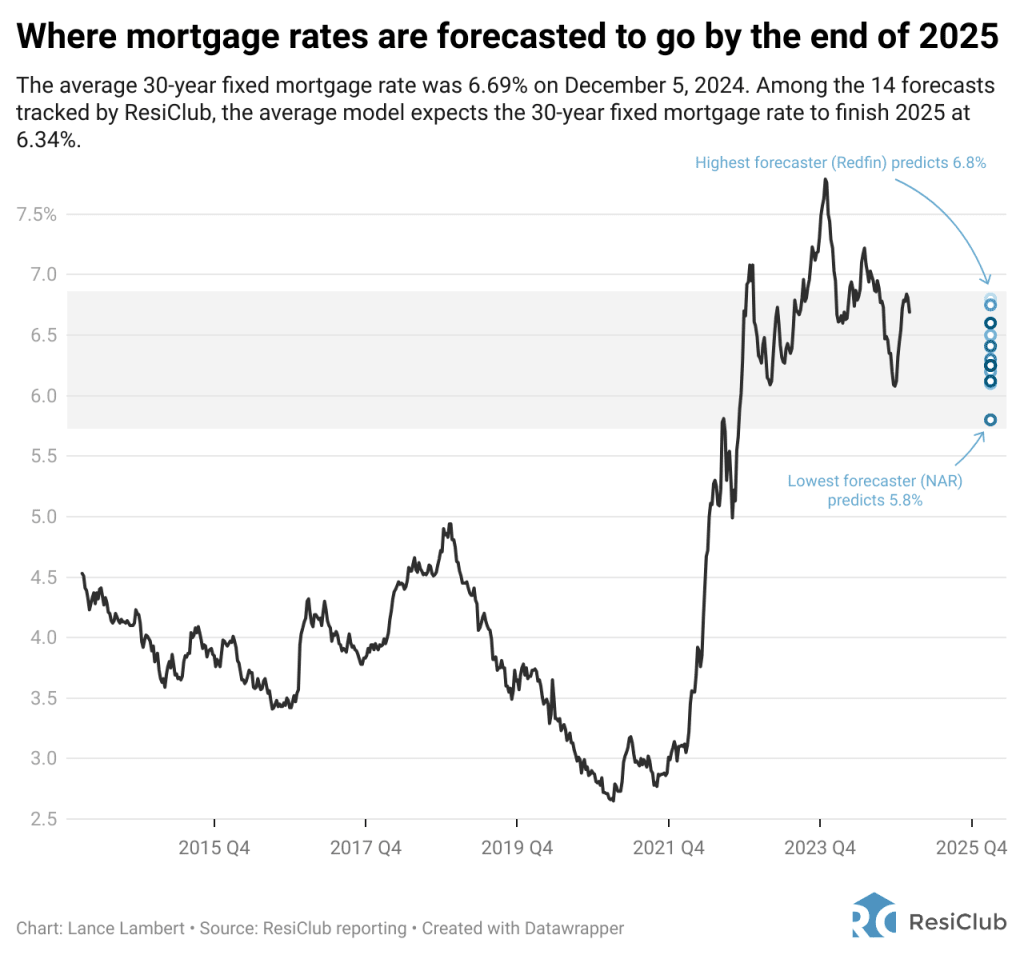

My call for 2025 is essentially “higher for longer”. Rates may be lower than at the beginning of the year, but an average of 7% is likely.

Almost no one with a 3% mortgage on an entry-level home will trade up to a 7% rate – it just doesn’t make financial sense. As a result, 2025 is likely to be a slower year with lower transaction volume. I expect national home prices to remain flat in 2025, increasing by 1% or 2%.

I predict more new home sales in 2025, but square footage will decrease. Builders will focus on smaller, entry-level homes.

I also believe that the incoming administration will work to make housing construction faster and cheaper, perhaps offering incentives to build entry-level housing. I don’t mean any “free money” first time home buyer programs. The last thing the market needs is more demand; we need supplies. If such a program were to materialize, my call for 2025 would be wrong because it would disrupt the current dynamic.

Many people see real estate as a way to build wealth for retirement, but don’t want to manage properties forever. As someone who once owned over 170 rentals, when did you decide to downsize and how did you plan for your exit?

You don’t have to control yourself. from the beginning [my wife and I] chose to invest in a market two and a half hours away while working full-time jobs. Property management was a necessity for us, so we found deals that could help cover the 10% management fee.

Although we no longer pay 10% today, having property managers from Day One has helped reduce the operational stress of direct management. That said, managing a manager is still important. We had to fire property managers, deal with theft and oversee operations to ensure everything ran smoothly.

However, we have never directly spoken to tenants, collected rent, or called for repairs. We have always paid someone else to perform these tasks.

As you approach retirement, other considerations come into play. For example, should you sell older properties and use a 1031 exchange to acquire newer ones? Newer features usually require less handling, which can significantly reduce headaches. A 1031 exchange also allows you to consolidate multiple properties into a single, high-quality asset.