Asking Lance Lambert more apartment market storiesResistubIn the Inbox? SubscribeResistubBulletin.

Last month, the new Treasury Secretary Scott Bessent, Federal National Mortgage Association (Fannie Mae) and Federal Home Credit Mortgage Corporation (Freddie Mac) can not push mortgage rates, he said.

“Currently is a priority tax policy – we will think about it after eliminating [ending conservatorship]. The priority of the Fannie and Freddie release is any research or sign that the most important metric I have looked at the mortgage prices. Something made around a safe and healthy release [of Fannie Mae and Freddie Mac] He goes to hinge with the influence of long-term mortgage rates, “he said.

Some of the Trump administration was interested in the end of Fannie Mae and Freddie Mac, Trump and Bessent’s Conservatory and interested in bringing long-term degrees and productivity. Bessent shows that fannie Mae and Freddie Mac can be superior to the conservative to reduce mortgage prices.

Frannie Mae and Freddie Mac, which supports the mortgage industry supporting the mortgage industry from Lenders and supports the mortgage supported valuable valuable valuable valuables (FHFA) in September 2008. The US Treasury gave a bunch to leave them, and they have been under government control so far, even though they return to profitability.

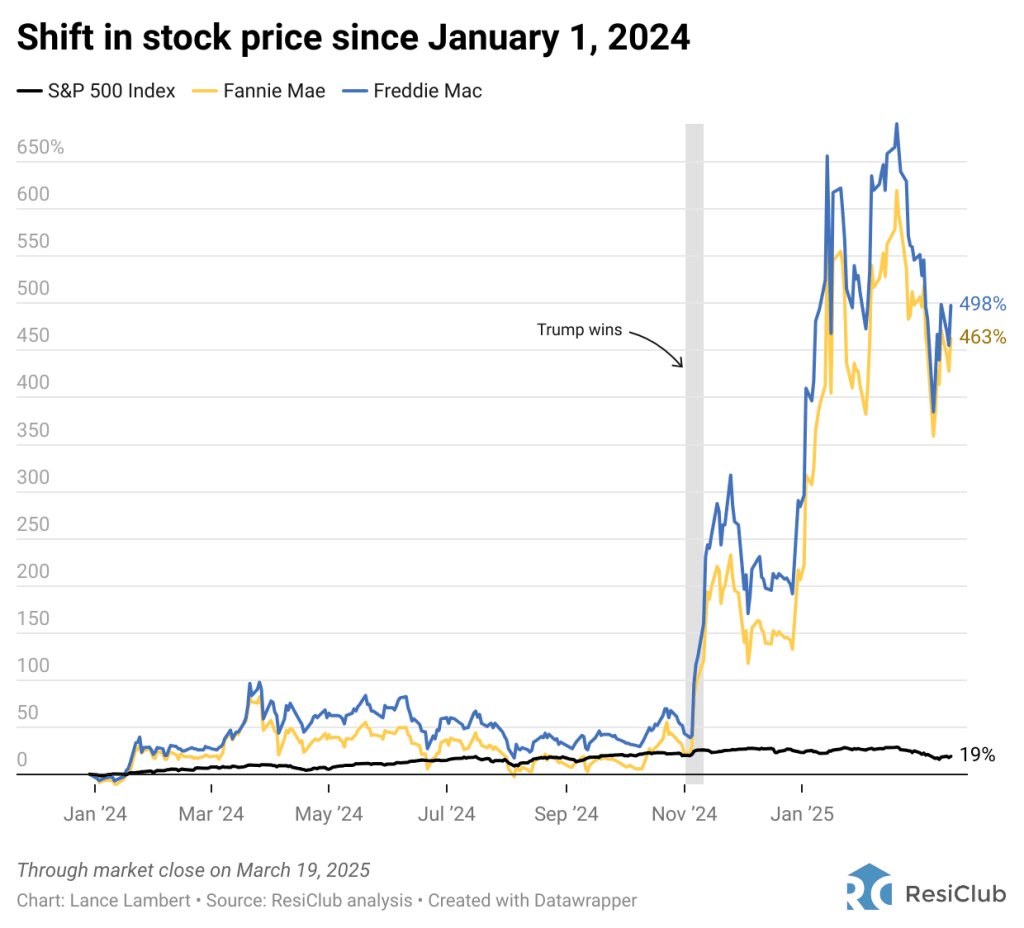

Although the US Treasury has a majority of their profits through the preferred share contracts, the general and preferred shares in front of the Conservatory have never been completely erased. Immediately after Trump’s November election winning, Freddie Mac and Fannie Mae began to be taken at a higher rate of exchange prices, but also a higher rate of conservatism.

Freddie Mac and Fannie Mae is the chief economist of the recycle economist for the housing market and mortgage ratios to better understand what is the report of Mark Zandi-several reports (including) 2017 and 2025) On the end of the conservatives that it can affect financial markets.

Zandi, five scenarios and each, including how to influence the mortgage ratio, including the government, including the government’s Fannie and Freddie’s “open” or “open” assurance provided.

“Open Guarantee”, the government’s Fannie Mae and Freddie Mac are officially provided by Mac’s liabilities, ensure that investors will be returned no matter what. This reduces the risk that leads to mortgage rates for investors. A “Secret Warranty” means that the government does not force GSES, but the markets are likely to intervene to prevent failure. (This was the 2008 financial crisis in 2008 that the 2008 government had to save GSES.) Because this scenario can lead to the highest debt costs, the investors require additional compensation for uncertainty.

1. Conservatory status kvo remain in place: 65% probability

“The situation quo [Government-Sponsored Enterprises] The most probable scenario, the remaining conservatives, “Zandi Resistub says”. This is the most probable scenario that it is compatible with the status quo and current mortgage rates. The housing financial system, GSES worked very well because it was made conservative in 2008. And Gses has been effectively privatized through transfers to credit risk to the private sector. In order to admit the conservatives to receive GSES, it is necessary to explain what the privatization is. ”

2. Leave Freddie Mac and Fannie Mae with “Secret Government Warranty”: 20% probability

“Release the GSES (SIFIS), which is a secret government guarantee, which dominates the conservatization of GSES,” Zanda said. “This returns to the future and GSES will be better capitalized and with a smaller and less risky balance sheet, and global investors will increase the 20-40 main point compared to the status quo for the typical borrower.

3. Full release of Fannie Mae without Freddie Mac and Fannie Mae’s “Secret” or “Open” government guarantee: 10%

“This is the current situation for a typical borrower, 60 years of fixed mortgage prices for 30 years of fixed mortgage prices compared to Quo,” Zandi projects. “The government would not be able to get the Federal Reserve GSES without warranty [mortgage-backed securities]And the rating agency has the risk that GSES will reduce debt and securities. The share of the Mortgage Market GSES will significantly reduce, and this will increase for private lenders [Federal Housing Administration]As a result of the exposure of more taxpayers, taxpayers carry all risks in FHA loans. ”

4. Freddie Mac and Fannie Mae’s “Open” Government Release: 5% Probability

“The release of GSES, which is an open government guarantee, can result in a small decline in mortgage prices (25 key points) compared to the current status quo. But it will be difficult and it will be difficult and [nearly] It is impossible to pass, “says Zandi.

5. Freddie Mac and Fannie Mae, full charter as government corporations: 0% probability

“[If the] GSES, government corporations (like Fannie Pre-1968) are adjusted by an open government guarantee, [this] The federal government will effectively code the current status quo to achieve a full faith and credit guarantee. This results in the lowest mortgage rates, and at the same time requires legislation, “says Zandi says.

Trump management is interested in any increase in mortgage rates, while Freddie Mac and Fannie Mae are released from the Conservatory. Taking into account the evidence presented by this concern and Moody’s, the management is fair to assume that it will continue with caution during next year. If the conservatory does not end, then the Trump leadership will take place, concerns about mortgage prices were resolved.