Asking Lance Lambert more apartment market stories ResistubIn the Inbox? SubscribeResistubBulletin.

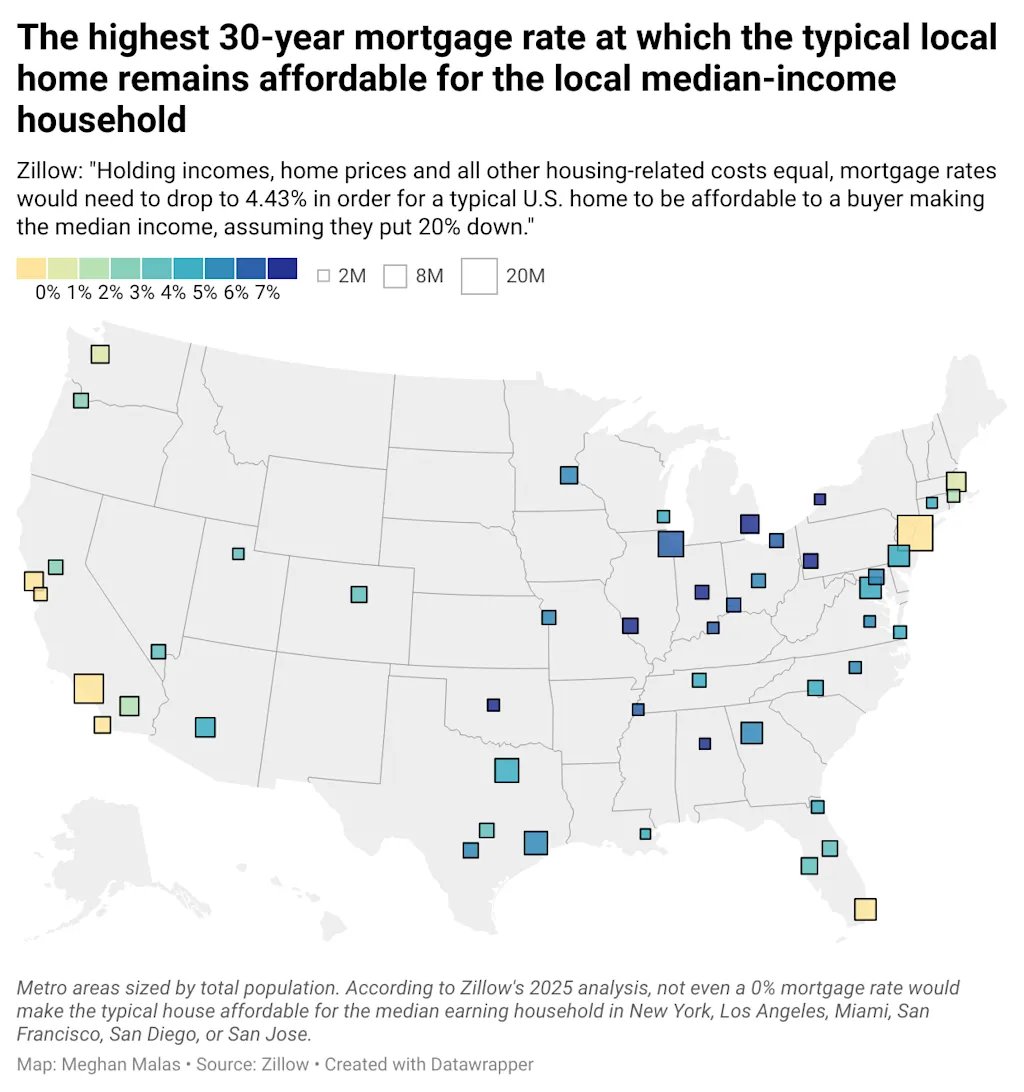

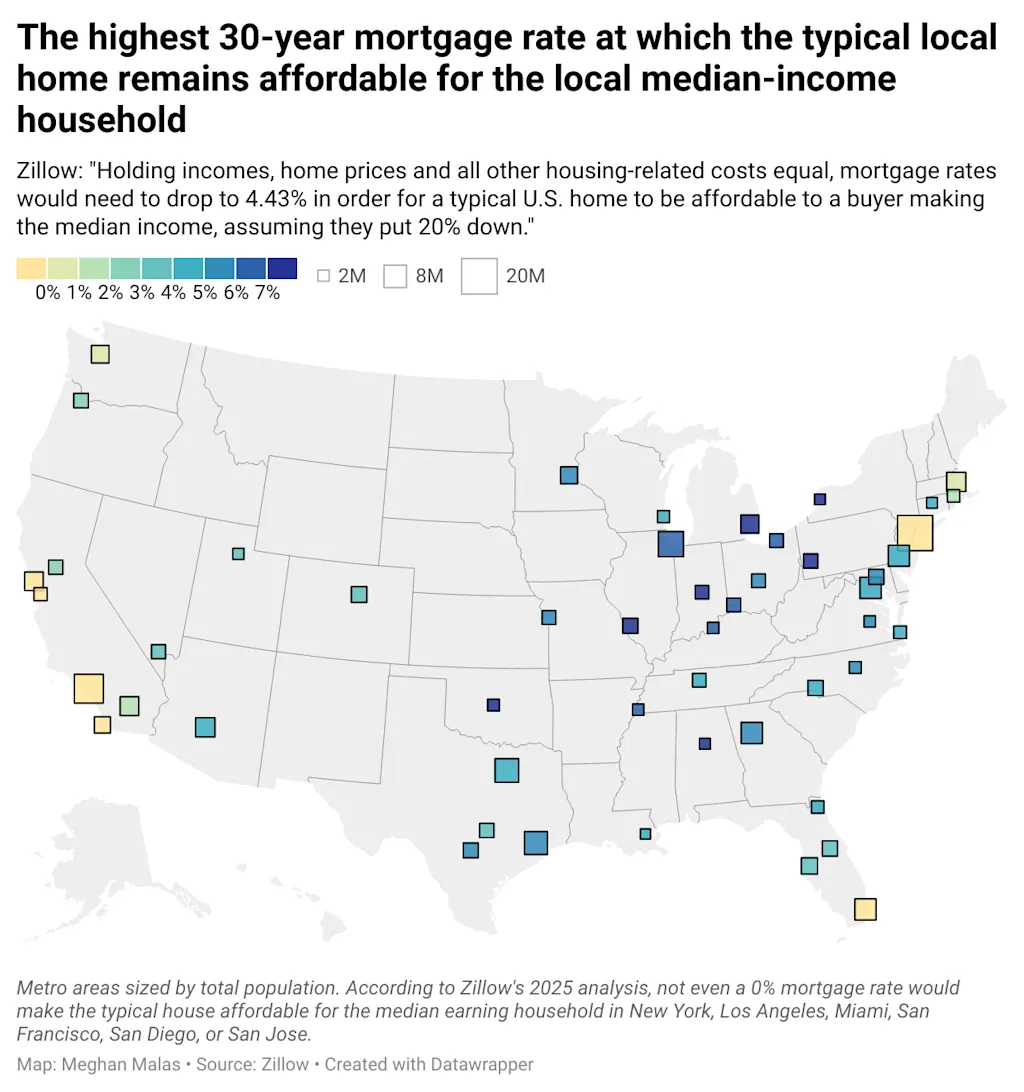

The last Zillow analysis shows that more than one percentage of more than one percent will be more than a smaller than 4.43%. And this is the first time buyers receive a 20% cheaper fee.

Even in several highly valuable coastal metroes, even 0% mortgage speed, a family that earned local median income will make the media’s valuable local home. This can consume more than 10% of a median-artistic median home maintenance and stored in a median-artistic median-artistic median household, in New York, Los Angeles, Miami, San Francisco, San Diego and San Jose.

On the flip side, Zillow, many Midwestern markets for median profitable buyers, mortgage prices are already smaller than mortgage prices in these areas.

Remember, this is an envelope math. The above mortgage scenarios are assumed that the other is equal to all of the other and low prices do not affect home prices.

Are you likely to see 30 years of fixed mortgage speeds at 4.43% 4.43%? Zillow economists say that the scenario was at least a “reality” in a short time.

“Catch income, [U.S.] Home prices and all other living expenses are equal, the mortgage rates need to drop a buyer to 4.43% to make a buyer set a buyer down 20%. The decline in such a ratio is currently unrealistic, “said Zillow economic analyst Anushna Prakash.

Prakash added: “If buyers are waiting for large drops in mortgage rates or [U.S. home] Prices to help availability are in for a rough awakening. Like falling proportions, such amendment will not occur without an increase in economic growth and income growth without increasing the growth of economic growth and income. “